The shift toward trusted brands

Consumers are shifting their engagement with crypto toward trusted, established, and traditional brands in the broader realm of financial services. The mainstream response has been to move towards tested, mainstream ...

Consumers are shifting their engagement with crypto toward trusted, established, and traditional brands in the broader realm of financial services. The mainstream response has been to move towards tested, mainstream brands with a longer track record of success – another symptom of a sector-wide flight to quality.

This trend aligns with Zero Hash’s thesis: every traditional financial services company will become a crypto company, and more broadly, every consumer business will become a crypto or web3 business. Consumers are placing heavier emphasis on the real-world utility and benefits of their financial products, and they increasingly want web3 and traditional financial services companies to be a part of the same single universe.

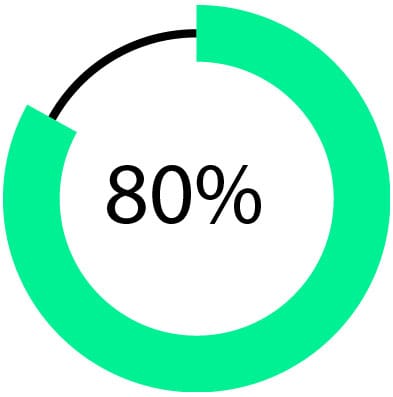

already use financial services companies, such as PayPal, to engage in crypto

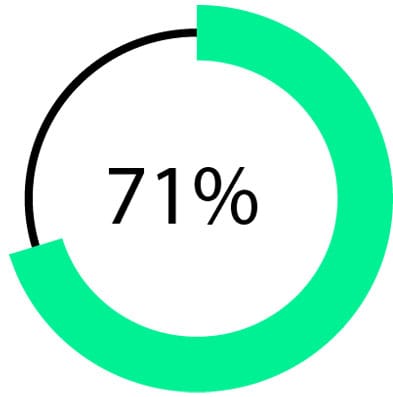

want to use a traditional financial service or consumer business to engage in crypto

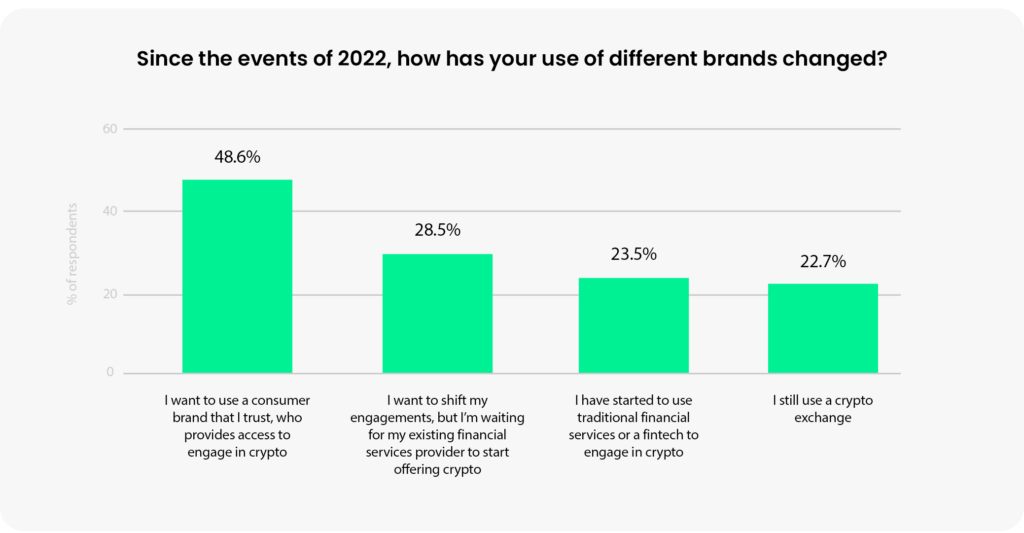

Consumers expressed a clear desire for traditional companies to offer crypto services. In fact, four in five respondents want to use such traditional companies for their crypto transactions – and 71% of respondents already do. Consumers sticking to crypto exchanges alone are in the minority (23%), while others are in the varying stages of diversifying their crypto activities towards traditional companies.

PayPal now holds $1 billion of customers crypto assets and Cash App generated $2.16b in Bitcoin revenue in Q1 2023.

The merging of web3 and traditional finance companies aligns completely with consumer preferences expressed in the survey. Reputation, regulation and the age of a company are the most important factors for selecting a company to engage in crypto. Traditional financial services companies perform well across these 3 factors.