Behind the shift

Why are consumers shifting their engagement to traditional and trusted brands? In short, they believe that traditional financial services companies offer greater protection. Protection – in the form of transparency, ...

Why are consumers shifting their engagement to traditional and trusted brands? In short, they believe that traditional financial services companies offer greater protection. Protection – in the form of transparency, custody, and security – is the foundation of trust.

said I feel traditional financial services offer better protection when engaging with crypto

said I use them for other financial services and trust them when engaging with crypto

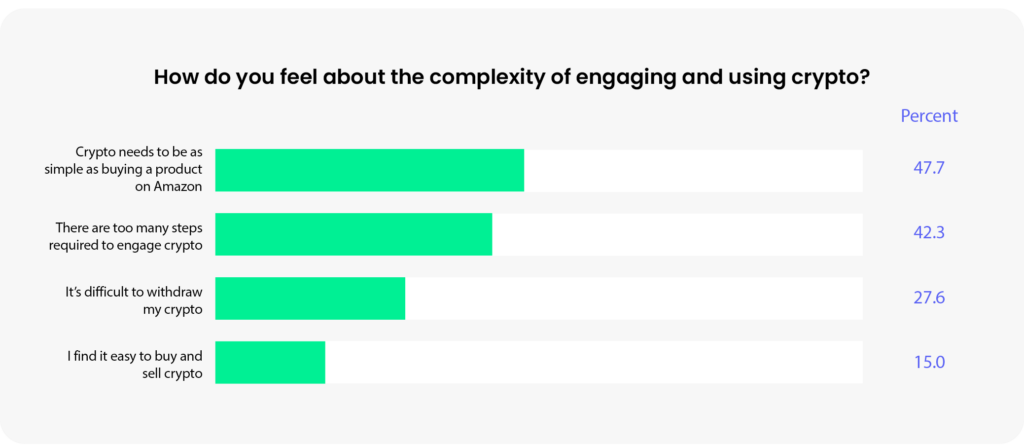

Beyond trust, consumers also prefer existing financial apps because they offer simpler user journeys. In crypto’s first wave of adoption, users were forced to follow lengthy technical processes to transact in crypto. By serving a wider, more mainstream audience, traditional financial services companies have attempted to streamline many steps in the journey, which is now becoming a competitive advantage.

Stripe’s fiat-to-crypto onramp enables users to checkout with Crypto as easily as debit cards.