Introduction

The evolution of crypto is movement to mainstream trusted brands.

We conducted this global study to evaluate exactly how consumer perceptions of trust, engagement, and utility have shifted over the past 12 months. What we learned is that consumers resoundingly want to engage in crypto and digital assets, but ‘Trust Matters’.

This study – the first of its kind – provides definitive data on consumer behavior in relation to crypto. The data clearly shows that, despite some of the challenges of the past year, crypto is here to stay: consumers are maintaining or increasing their engagement, they are holding their providers to higher standards, and traditional brands are seeing upside from integrating crypto into their offering. A tangible illustration of this is how Zero Hash powers

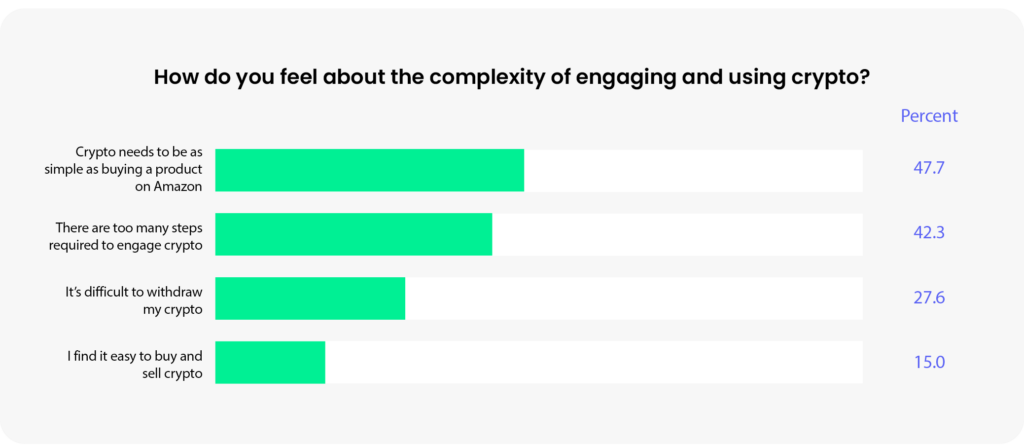

Stripe’s crypto payments experience, making it easier to interact with web3 merchants and apps, through a checkout flow as simple as making a purchase on Amazon.

The most impactful conclusion from the study is the fundamental shift in how consumers want to access crypto. Consumers resoundingly want to engage with brands they know and trust. The boundaries between traditional finance and crypto are blurring, as consumers look to traditional companies to access Web3 products that offer greater speed, security, and flexibility.

There is a trend of convergence of companies building and launching crypto offerings to their large customer bases. PayPal and Cash App’s recent revenue announcements have demonstrated continued appetite from consumers to engage in crypto. More fundamentally around cryptograph technology, the aggregate transaction value of fiat-backed stablecoins surpassed the transaction volume of Mastercard and PayPal combined1. By the end of 2023, it’s expected that on-chain stablecoin volumes will surpass Visa volumes2. Or take cross border payments, a $190tr global industry. 25% of US cross-border remittance senders use crypto3 to benefit from faster, cheaper, and more secure payments.

Another burgeoning use case where we expect the convergence of traditional companies is in the use case of cross border payments, specifically, payroll. Crypto payments are attractive to people who use cryptocurrencies as a hedge against local currency instability, those whose outdated local banking systems slow down payroll, and people who are adding cryptocurrencies to their investment portfolio.

In this report we sought insight and expertise from companies including Stripe, tastytrade, Circle, Plaid, WorldPay, Shift4, Tap Global and Brazil Crypto Report, who believe as we do that trust, simplicity and utility are the essential keys to driving the next wave of adoption and unlocking the potential of crypto and blockchain technology.

Edward Woodford

Founder & CEO

Zero Hash

About the study

In partnership with Propeller Insights, Zero Hash conducted a survey with 3,000 consumers in the US, UK, Brazil and Australia to evaluate their engagement and confidence levels in the crypto ecosystem. The survey participants comprised 50% in the US and 17% in the UK, Brazil and Australia. 45% of survey participants were existing crypto users and 55% were non-crypto users.

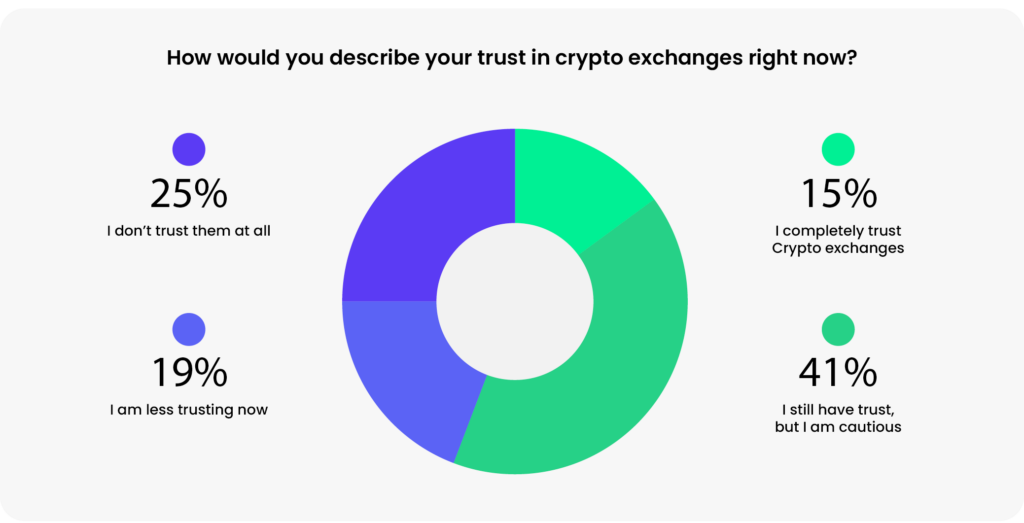

Trust is the critical component

Consumers around the world echoed a similar sentiment: trust in crypto has suffered a setback. Across all consumer segments and geographies, respondents felt the greatest loss of trust in crypto platforms. This phenomenon is easily understood, since liquidity shocks centering around this category of companies received the greatest publicity and affected consumers in tangible, direct ways.

Crypto users and non-users are less trusting of exchanges

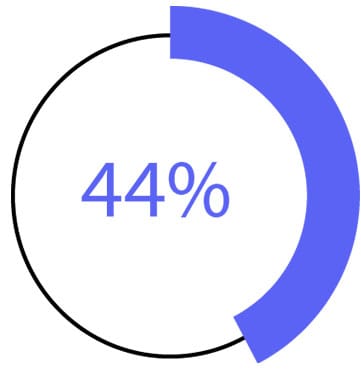

Said their trust

was diminished

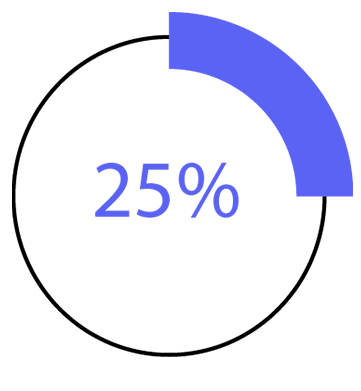

Would never use a crypto exchange again

Do not believe information that comes from a crypto exchange

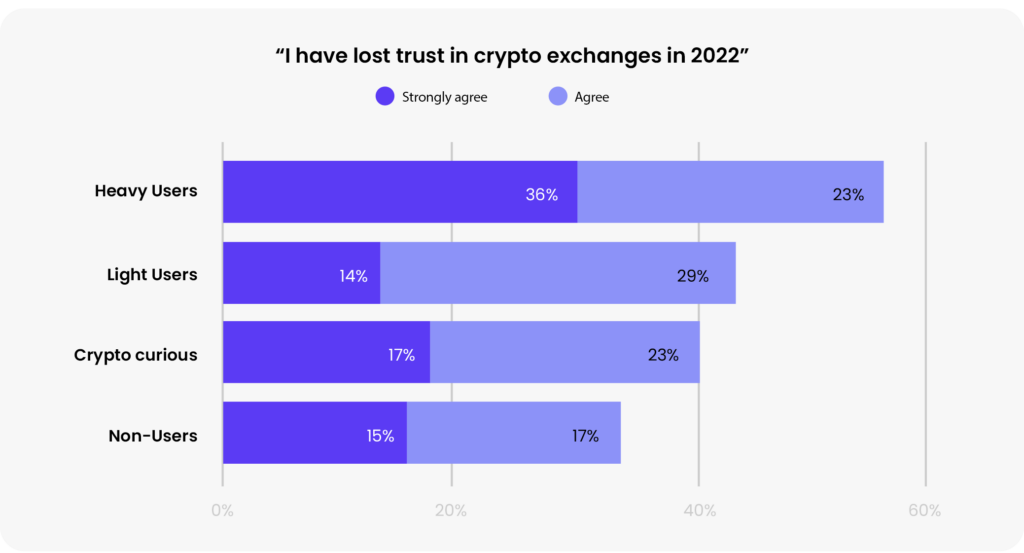

Consumers are showing resilience

Crypto users felt the biggest trust setback, following a general trend: Consumers that were the most engaged had the strongest trust in crypto exchanges before 2022; since their trust began at a higher point than all other groups.

While this data reflects a new obstacle in the industry, it offers crypto and crypto-adjacent companies clear, quantitative evidence that trust is the critical ingredient in adoption. When we dug further into the data, we found that consumers displayed resilience in their crypto engagement. These consumer beliefs offer insight into the future of crypto as a trustworthy and dependable suite of use cases with real-world utility.

Consumer resilience in crypto

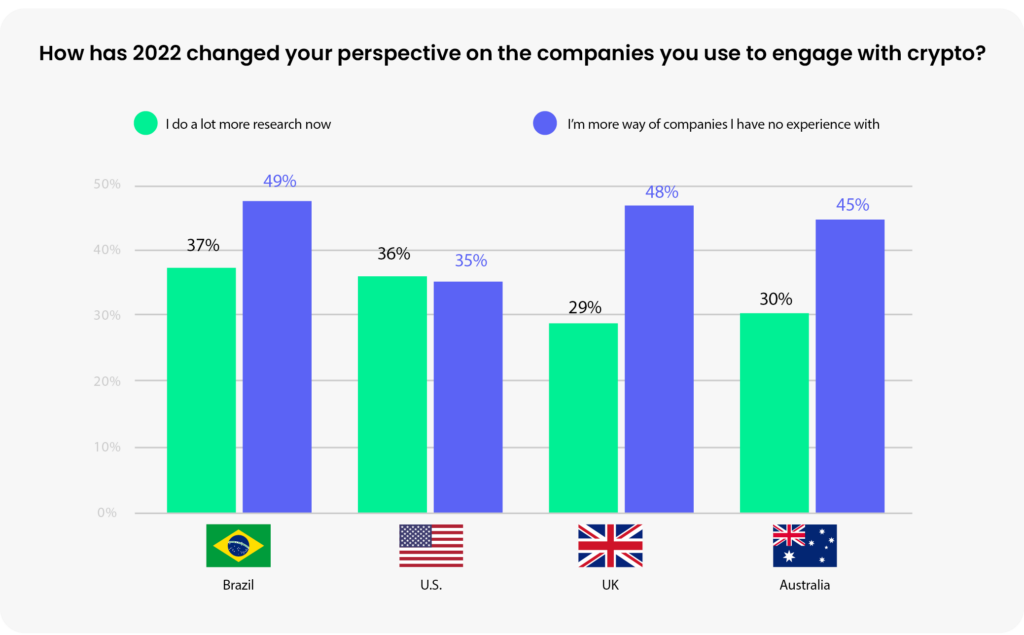

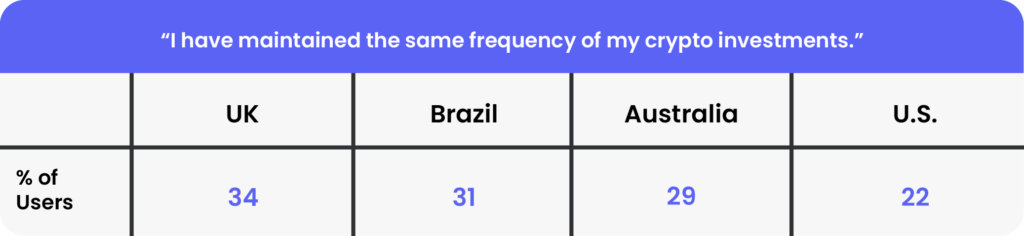

While the data displayed trust erosion, consumers display resilience in their crypto activity, and continue to engage with crypto – albeit with a new set of priorities. If the first wave of industry growth was fuelled by FOMO and speculative engagement, then the second wave will be fuelled by true utility and due diligence.

None of us in the crypto ecosystem would have hoped for anything like the shocks that precipitated in 2022. These shocks, however, come with silver linings. Consumers have a stronger, more rigorous perspective in their crypto dealings, and holding their providers to account will only serve to strengthen the utility and compliance of the ecosystem as a whole. We’re beginning to observe a ‘phoenix’ effect: after many players have perished in a sector-wide blaze, the industry rising from those ashes is shaping up to be stronger with stronger foundations.

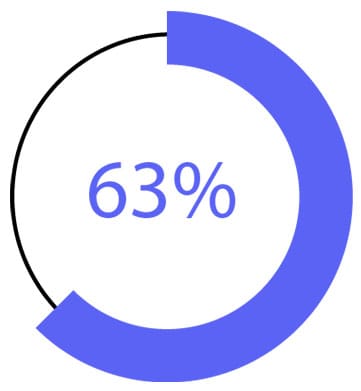

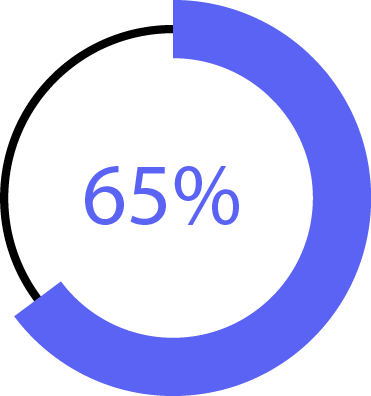

Consumers are cautiously engaging

As the saying goes: “Fool me once, shame on you. Fool me twice, shame on me.” Consumers are adhering to this credo by continuing to engage with crypto while displaying a higher, healthier level of skepticism of their providers.

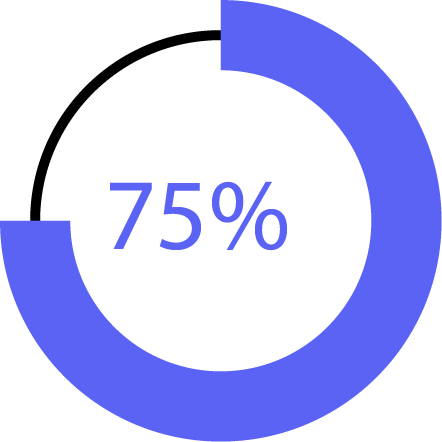

of respondents still trust

crypto exchanges

of users report doing more due diligence/research and being much more cautious in engaging with companies they have no experience with

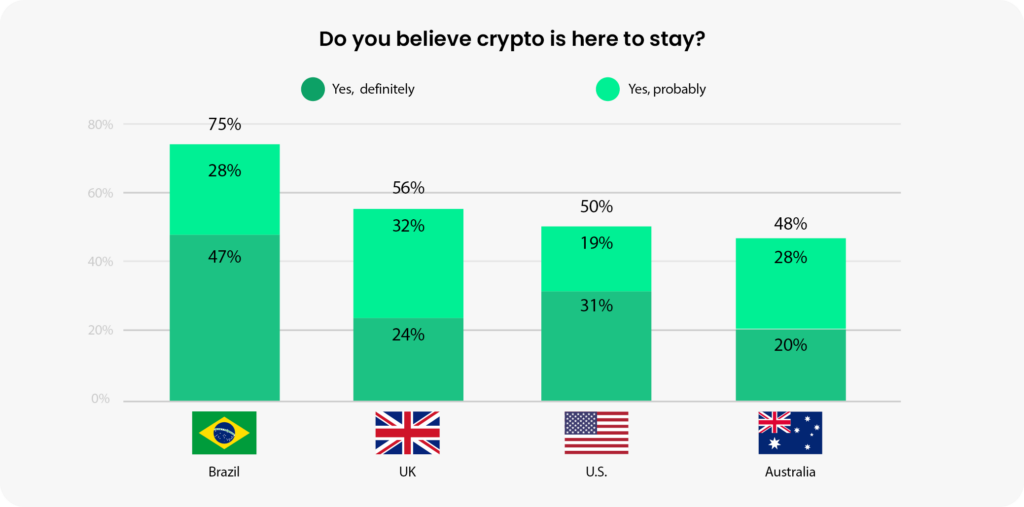

Yet consumers believe crypto is here to stay

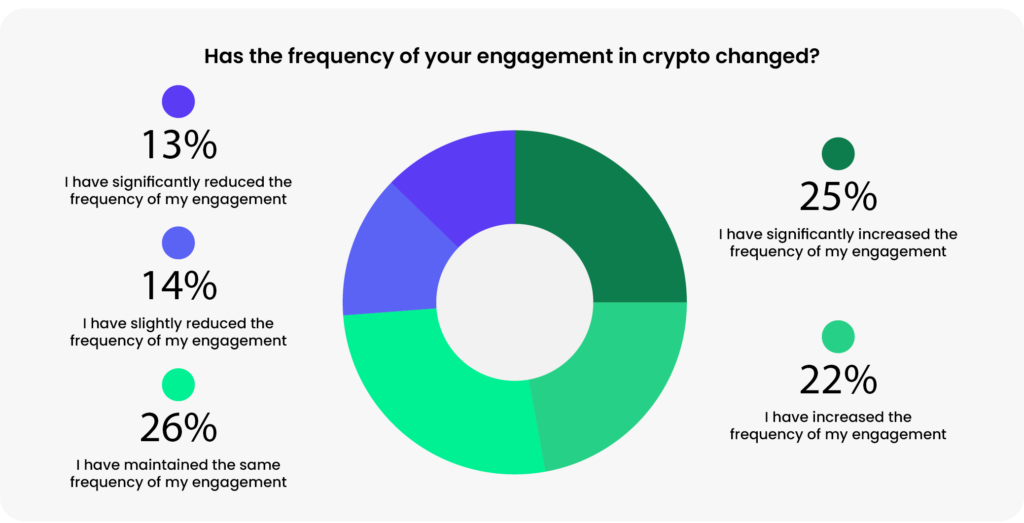

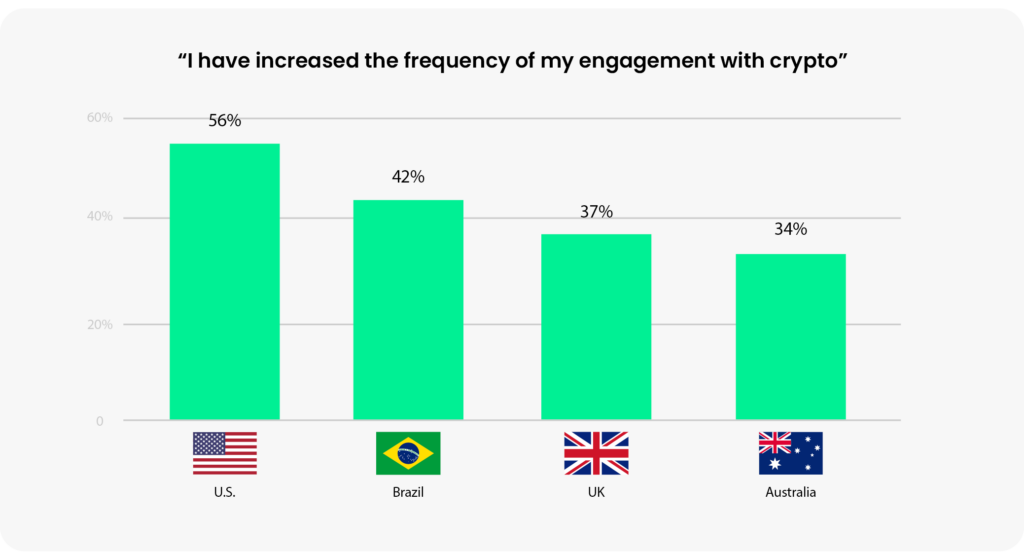

It would be reasonable to presume that trust setbacks would discourage consumers from engaging with crypto. Yet the majority of consumers are doing the opposite and are increasing their engagement. On average, three in four consumers have maintained or increased their engagement since 2022.

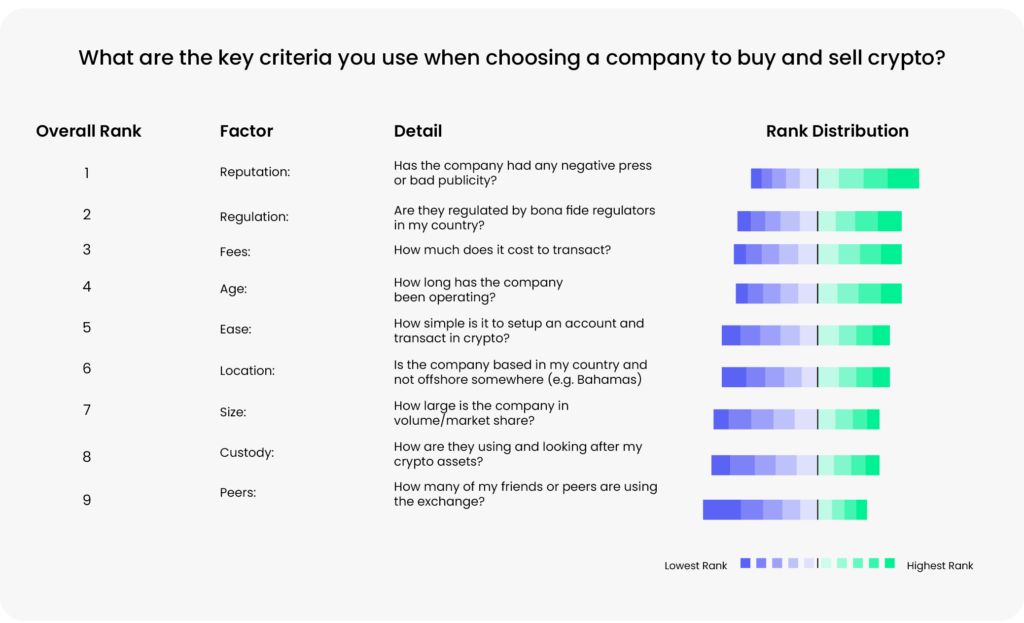

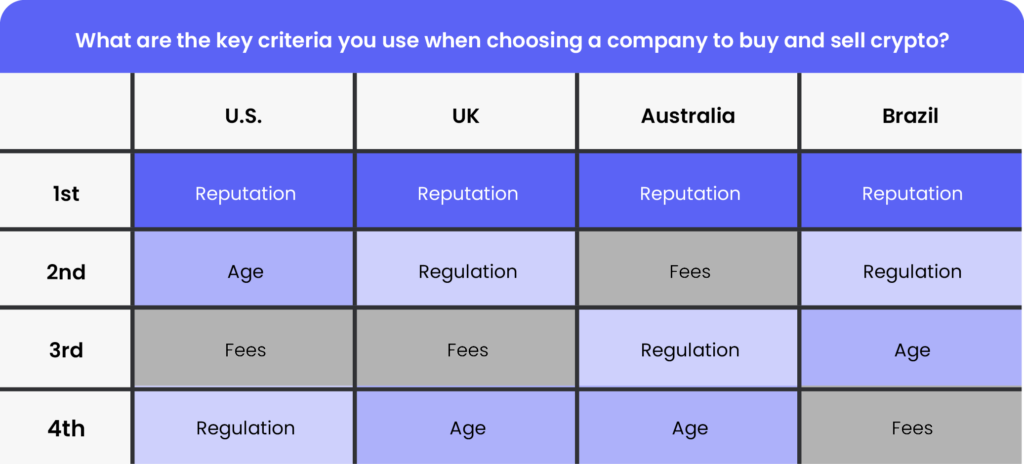

Reputation now matters more than price

When performing due diligence, the two most important factors to consumers are a company’s reputation and regulatory standards, as opposed to price, which is typically a top decision-making factor.

Factors that are traditionally imperative for consumers — such as fees and simplicity of use — are now secondary to trust factors. Customers are willing to pay a premium for peace of mind, a trend we think of as a growing ‘trust premium’.

Interestingly, the time that a company has operated is highly important – nearly as important as fees. Consumers recognize that trust takes time to build, so incumbents have a trust advantage.

Overall, we interpret this trend as a flight to quality: while consumers now exert greater scrutiny over their service providers, most are long-term believers who seek to replace dubious providers with trustworthy ones.

Somewhat surprisingly, users report that a company’s custody protocols are relatively less important compared to other decision-making factors. This is surprising because many consumers previously lost their crypto because of improper asset custody, which enabled untoward practices like re-hypothecation.

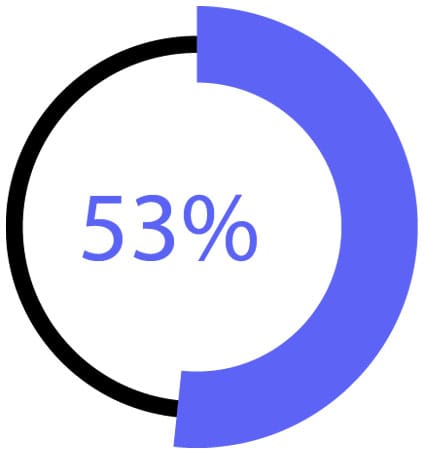

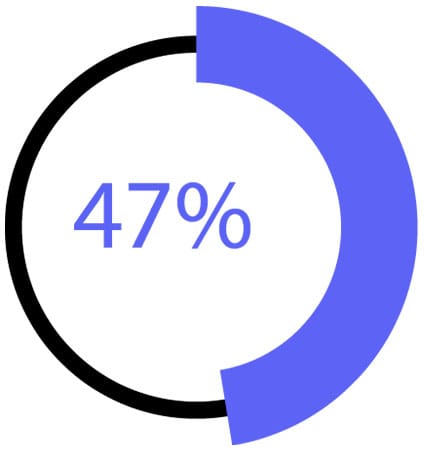

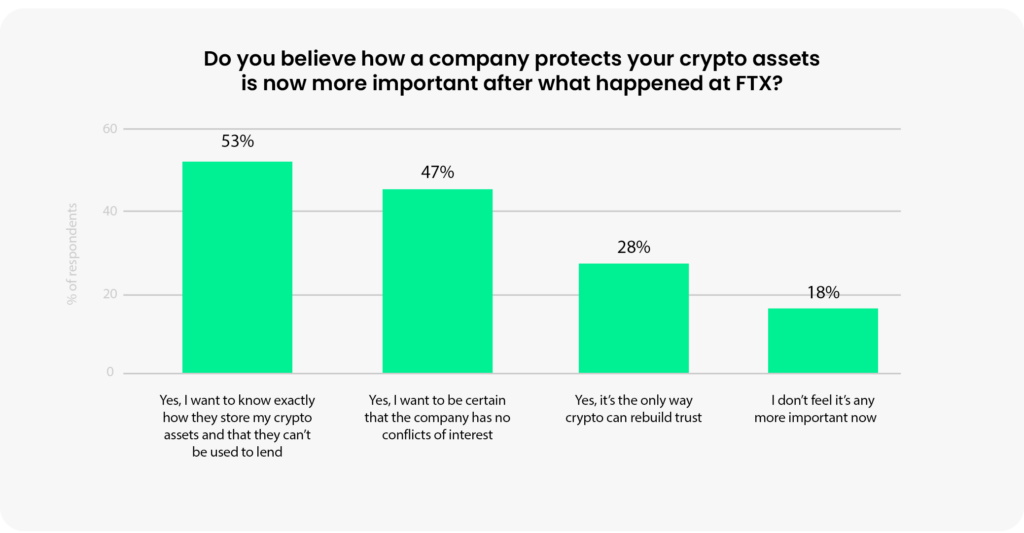

On one hand, it seems that consumers may be using reputation and regulation as a proxy indicator for custody. On the other, it’s possible that the term ‘custody’ is not commonly used or well understood by mainstream consumers. While users did not list custody as a key decision-making factor, elsewhere in the survey they expressed that the events of 2022 have made them more conscious of how their assets are stored: 53% stated that they want to know exactly how assets are stored and that their assets can’t be used to lend, and 47% want to be certain the company has no conflicts of interest.

stated that they want to know exactly how assets are stored and that their assets can’t be used to lend

want to be certain the company has no conflicts of interest

These data points indicate that custody is still a factor for customers, and the primacy of other factors in decision-making does not imply that custody should be any less important to providers. It’s now incumbent on crypto companies to make custody protocols robust, secure, and transparent.

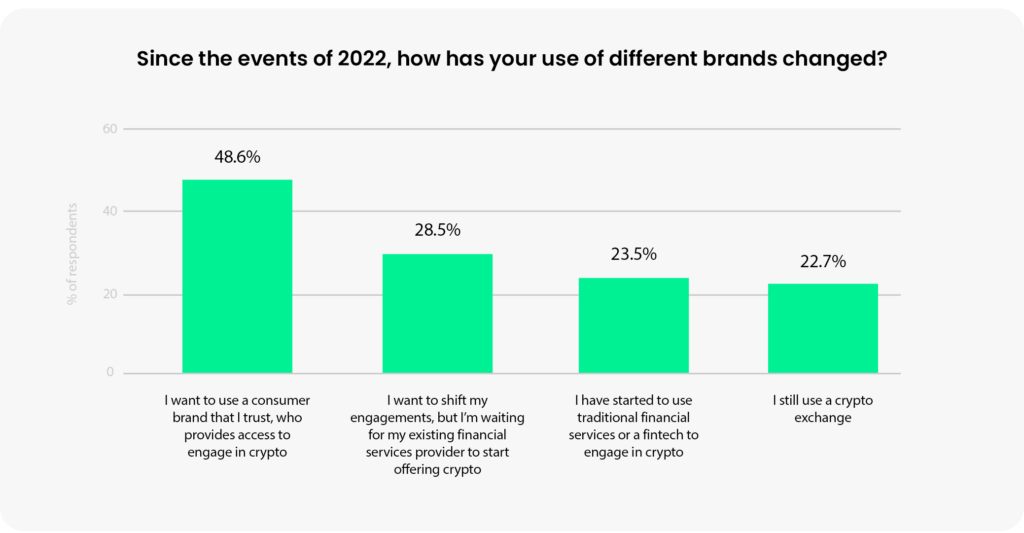

The shift toward trusted brands

Consumers are shifting their engagement with crypto toward trusted, established, and traditional brands in the broader realm of financial services. The mainstream response has been to move towards tested, mainstream brands with a longer track record of success – another symptom of a sector-wide flight to quality.

This trend aligns with Zero Hash’s thesis: every traditional financial services company will become a crypto company, and more broadly, every consumer business will become a crypto or web3 business. Consumers are placing heavier emphasis on the real-world utility and benefits of their financial products, and they increasingly want web3 and traditional financial services companies to be a part of the same single universe.

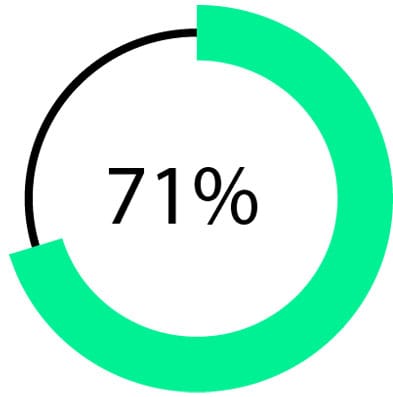

already use financial services companies, such as PayPal, to engage in crypto

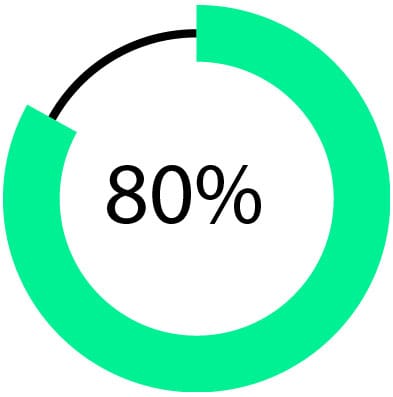

want to use a traditional financial service or consumer business to engage in crypto

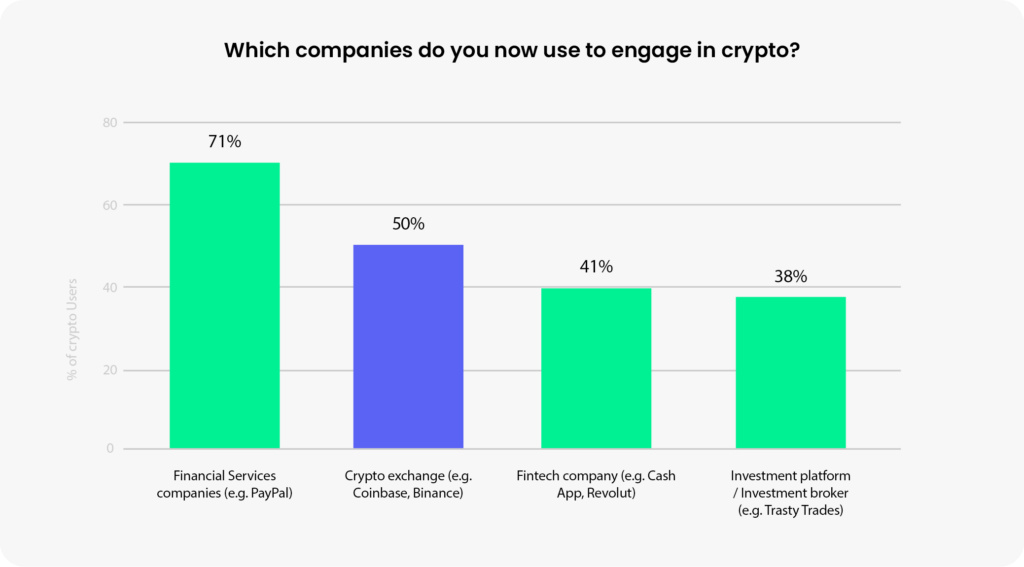

Consumers expressed a clear desire for traditional companies to offer crypto services. In fact, four in five respondents want to use such traditional companies for their crypto transactions – and 71% of respondents already do. Consumers sticking to crypto exchanges alone are in the minority (23%), while others are in the varying stages of diversifying their crypto activities towards traditional companies.

PayPal now holds $1 billion of customers crypto assets and Cash App generated $2.16b in Bitcoin revenue in Q1 2023.

The merging of web3 and traditional finance companies aligns completely with consumer preferences expressed in the survey. Reputation, regulation and the age of a company are the most important factors for selecting a company to engage in crypto. Traditional financial services companies perform well across these 3 factors.

Behind the shift

Why are consumers shifting their engagement to traditional and trusted brands? In short, they believe that traditional financial services companies offer greater protection. Protection – in the form of transparency, custody, and security – is the foundation of trust.

said I feel traditional financial services offer better protection when engaging with crypto

said I use them for other financial services and trust them when engaging with crypto

Beyond trust, consumers also prefer existing financial apps because they offer simpler user journeys. In crypto’s first wave of adoption, users were forced to follow lengthy technical processes to transact in crypto. By serving a wider, more mainstream audience, traditional financial services companies have attempted to streamline many steps in the journey, which is now becoming a competitive advantage.

Stripe’s fiat-to-crypto onramp enables users to checkout with Crypto as easily as debit cards.

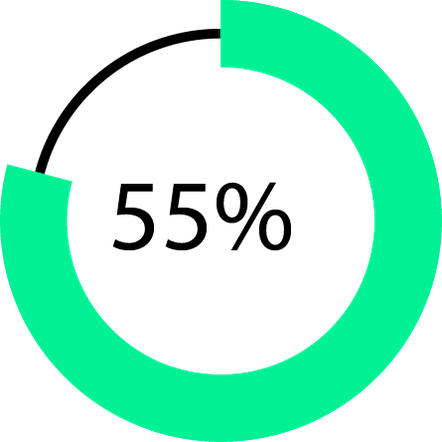

Consumer and non-financial tech brands also stand to benefit from the shift

Across all countries and demographics, when asked if they could choose any brand to engage in crypto:

63%

would trust a tech brand like Amazon to engage in crypto

43%

would trust a consumer brand like Nike to engage in crypto

40%

would trust a consumer brand like Walmart to engage in crypto

Reddit now has more NFT wallets than Opensea. They have onboarded over 3 million non-crypto-native users to Web3 with their NFT launch.

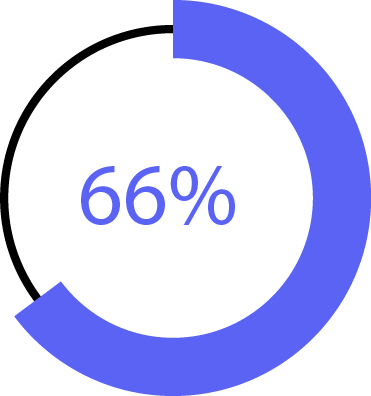

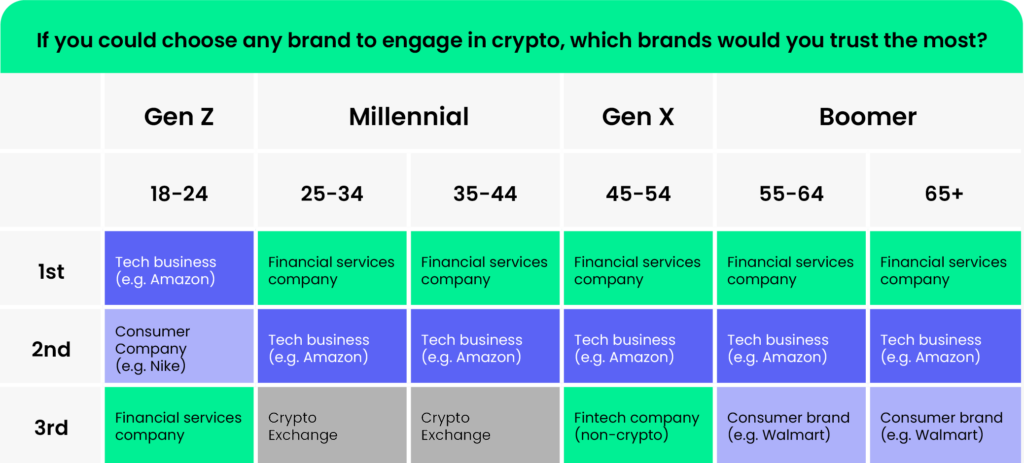

The generational divide

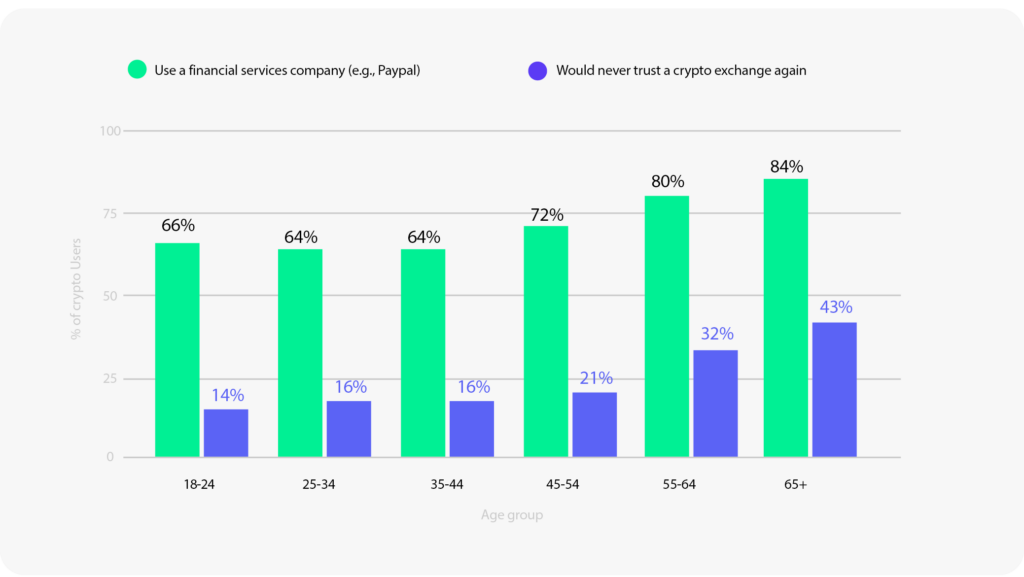

The sector shift toward trusted web2 companies is evident across all age groups, but not all generations have adapted their preferences uniformly.

Traditional financial services companies have become the undisputed companies for which consumers want to engage in crypto, surpassing crypto exchanges. This presents empirical evidence that across all demographics, consumers are shifting to brands they trust.

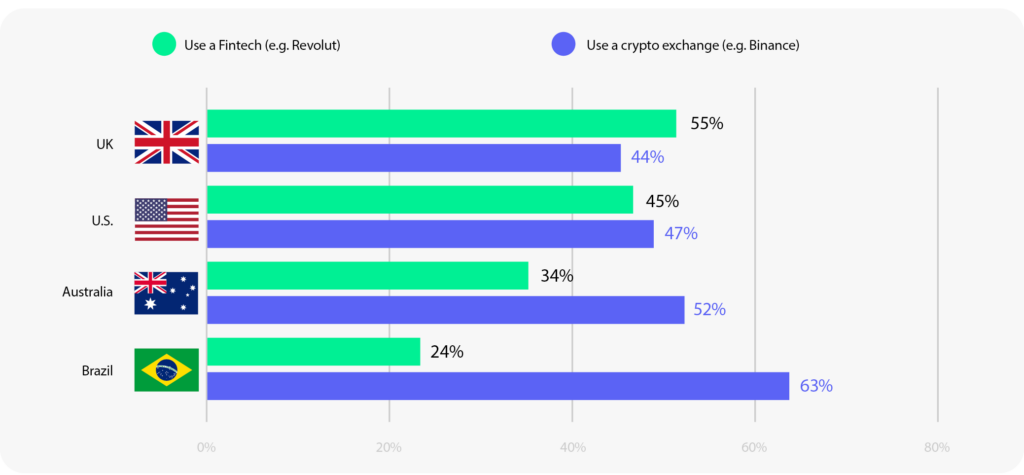

Equally, consumers have also demonstrated a movement to other industries too. There has been increased movement to investment platforms and fintech companies to engage with crypto. This further demonstrates the trend of the convergence between traditional finance and crypto.

The preference for traditional financial services companies is most prominent amongst older generations. This generational gap is likely driven by the fact that Baby Boomers and Gen X grew up with traditional financial services brands and now have an affinity for these. Younger generations, who have lived through the rise of fintech and the proliferation of tech brands, display a willingness to consume crypto from non-traditional financial services companies.

Gen Z stands out most prominently from other generations: 66% would most trust a tech business like Amazon to engage with crypto, while others prefer traditional financial services companies.

Crypto rewards: a no-brainer loyalty opportunity

As a nascent industry, crypto has been relying on new user penetration to drive growth. That’s precisely why trust is so important, since it paves the way for new customers to enter the ecosystem.

Our report shows that there’s a strong opportunity to unlock a whole new wave of users into crypto: crypto rewards.

Across all geographies,

crypto rewards were ranked more desirable than air miles for rewards consumers would prefer to receive

However, only 18% of respondents are receiving crypto rewards today

Nubank has issued their own token to their 70m users, which will reward customers for engagement and loyalty. This initiative takes crypto beyond simply a buy and sell asset and uses blockchain technology to revolutionize how consumers are personally rewarded for their engagement.

Geography: Consumer views around the world

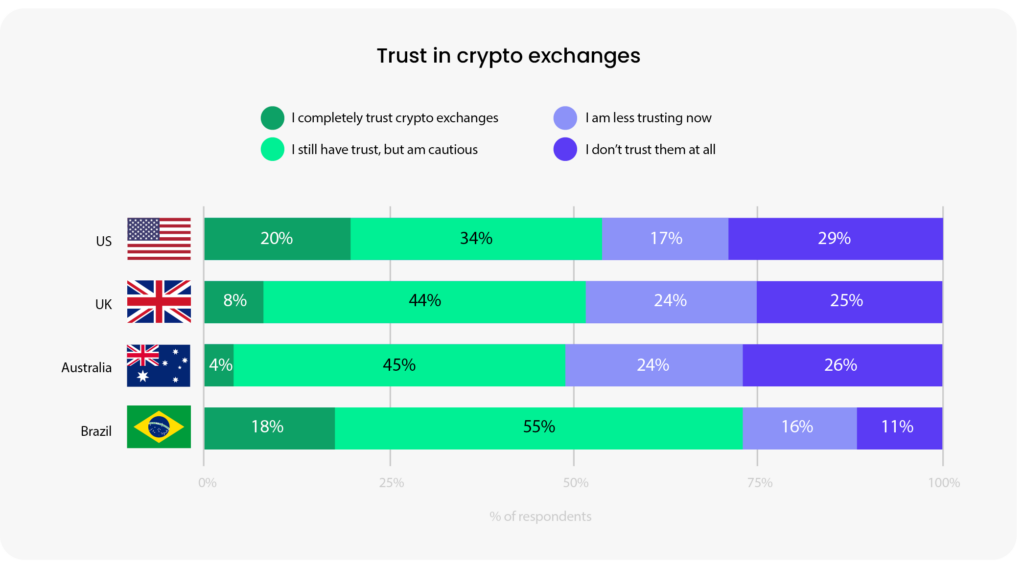

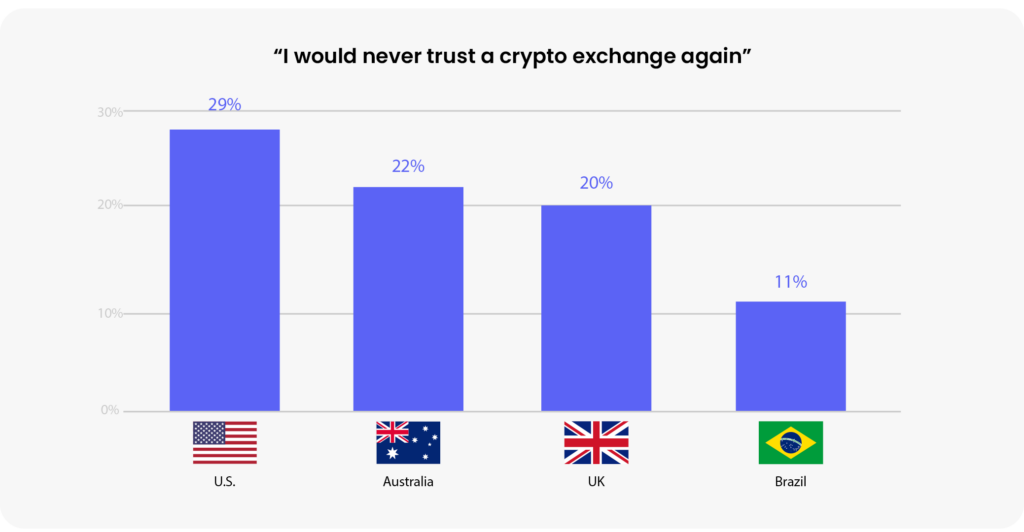

Across the 4 countries we surveyed, trust in crypto exchanges diminished.

U.S.

The USA is a hub with an estimated 52 Million Americans holding crypto1, therefore it’s no surprise that the US is one of the most crypto-optimistic markets in the world. However, the relative stability of the crypto ecosystem and broader financial markets meant that 2022 served as a shock to the system – especially since some of the most prominent collapses happened on home turf.

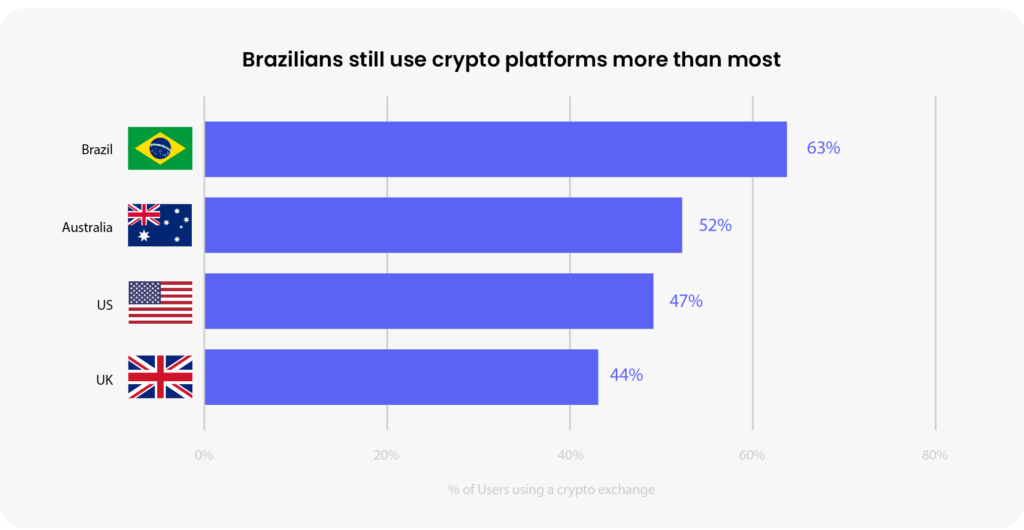

Americans are now the least likely to use a crypto-native platform – perhaps because of the some of the collapses on home turf.

However, US consumers are still the most resilient and engaged in crypto after the crash, pointing to long-term belief in crypto.

Americans, somewhat surprisingly, seem to care the least about regulation.

Brazil

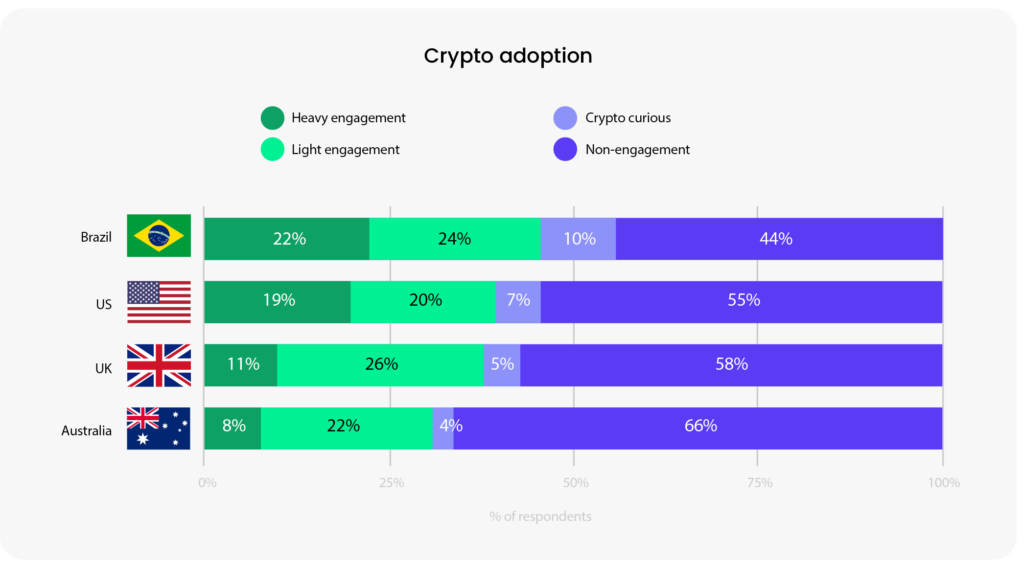

Brazil is – by a wide margin – the land of crypto optimists. Consumer preferences, a flexible regulatory environment, and a fluctuating macroeconomic context have propelled it to one of the world’s most advanced crypto hubs. Brazilians also display remarkable resilience after 2022, displaying high levels of crypto-optimism balanced by increased diligence and caution. In many ways, Brazil is a shining example of learning lessons from mistakes and moving forward boldly.

Brazilian adoption is the highest of any other country surveyed.

Brazilians have the firmest long-term belief in crypto.

At the same time, Brazilians are the most cautious and perform the most due diligence when they select a crypto company.

Why is Brazil so resilient?

Higher pre-existing rates of fraud have conditioned Brazilians to approach finance (including crypto) with greater diligence than most. Shocks like the FTX collapse create greater damage when they come as surprises, but Brazilians generally seem to have learned from past bruises to protect themselves against the worst.

This ‘eyes wide open’ approach from consumers, regulators, and enforcement agencies communicates a clear message: Brazil will learn from its mistakes and build a better future. So far, it’s working.

U.K.

The UK has generally followed trends set by the US, though Brits are more measured in their crypto decisions. Before the crash, Britons were less crypto-optimistic than Americans and Brazilians, yet they remain the most consistent in their engagement with crypto.

UK crypto users have been the most consistent in their crypto engagement activity.

Fintech is mature in the UK, with more consumers using fintechs for their crypto transactions than crypto platforms.

Australia

Australia is a unique opportunity: with all of the requisite fundamentals to support a thriving crypto ecosystem, it has great potential for adoption growth. However, the series of crashes pose a new challenge that will require the crypto industry to be intentional and diligent with their trust-building efforts.

Australians have begun the crypto adoption journey, but many are still on the fence.

Crypto penetration, the lowest amongst countries surveyed

Have doubts that crypto is here to stay, the highest amongst countries surveyed

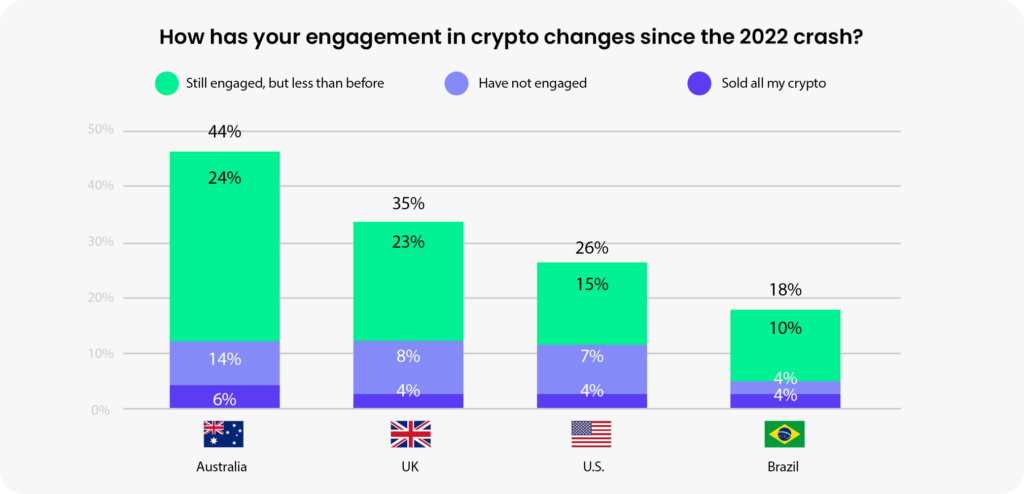

Australians were the most affected by the crash, with nearly half of consumers reducing their engagement.

In the wake of the crash, Australians have the least faith in crypto exchanges.

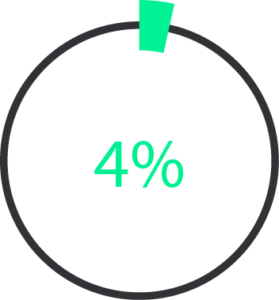

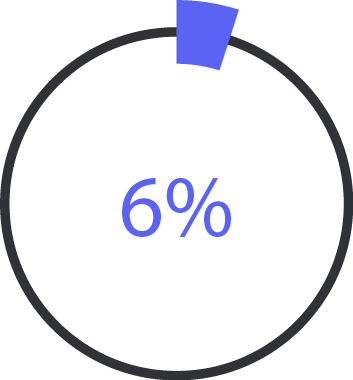

Only 4% completely trust crypto exchanges

Only 6% are very likely to trust what crypto exchanges tell them

With trust in doubt, they’re looking for consumer businesses to fill the gap.

Half of Australians said they would most trust a consumer business like Nike to engage in crypto – more than any other country surveyed.

Education, reputation and utility will drive further adoption

The research shows that it will be up to the entire sector to invest effort into communicating their ‘trust credentials’ with consumers, beginning with better transparency and educational resources to show consumers how the industry prioritizes safety. Equally important, is to move the conversation from educating consumers on blockchain and crypto to embedding them into trusted apps and companies that consumers use and are familiar with today. Consumers simply want a solution that’s better than what they have access to today and crypto / blockchain powered services can be the invisible infrastructure to achieve that.

Circle publishes monthly attestations which provide assurance that the amount of USDC reserves are greater than the amount in circulation each month.

Accelerating from speculation to real-world utility

The flood of capital into crypto created an explosion of speculation.

Now, that speculatory wave is giving way to a wave characterized by real-world utility.

One of crypto’s most common industry-wide critiques was that web3 products were ‘solutions in search of problems’. Innovators knew that crypto had clear benefits over previous technologies, but products needed time to test fit with their intended markets.

While there were inevitably some products and solutions that did not address clear customer needs, the growing fusion of web2 and web3 indicates that crypto is here to stay. With the benefit of time and experience, it has become clear where blockchain technologies can solve real user problems throughout B2C and B2B value chains.

Today, the industry has an opportunity to accelerate from the first wave of speculation into the second wave of utility. This new era will see web3 seeming more as a set of blockchain-enabled solutions that address real-world problems.

As we make this transition, it shouldn’t surprise us if terms like ‘blockchain’ and ‘web3’ move into the background. This is sometimes compared to how users of the internet have no concept of http. Consumers don’t necessarily need to know that they’re using blockchain when this technology stack powers the products and solutions they use. They’ll simply benefit from more seamless and secure experiences.

In the future, we believe that blockchain will become so embedded in financial and non-financial worlds that users may not even need to know that they’re interacting with it. The next wave will see crypto make this transition, where crypto moves from being in the foreground into the background. This is simply a reflection that blockchain technologies, with their potential for faster, frictionless, and more secure transactions, will become normalized. For example, in the payments use case, when a blockchain can provide a cheaper, faster, and more reliable vehicle to do that, then customers will use it. Ultimately, businesses and their consumers will focus more on functionality and benefits rather than the underlying technologies powering these products.

Real-world utility examples

Stablecoins: Moving Dollars at the Speed of the Internet

Some use cases of Stablecoins are “crypto-native,” like decentralized services that don’t support conventional bank accounts but want to utilize U.S. dollars. Some are “crypto-adjacent,” like the growing list of venture capital firms that fund investments with stablecoins rather than dollars. And some are more traditional: For instance, more than 500,000 users in Latin America (principally Venezuela) have signed up to use a stablecoin service called Reserve, helping them access dollar stability as a shield against political and economic uncertainty.

Source: Crypto use cases: 12 real-world stories of how millions of people are using crypto services today

Music NFTs: Artists Sharing Royalties With Fans

One of Rihanna’s producers partnered with Web3 startup Another Block to sell 300 non-fungible tokens, or NFTs, that entitled their owners to a percentage of the royalties generated by one of her most popular songs.

Source: Crypto use cases: 12 real-world stories of how millions of people are using crypto services today

International Payroll: Using Bitcoin to Activate the Global Gig Economy

One survey found that more than two-fifths of people across 76 different countries regarded bitcoin as more trustworthy than their local currency. Also, any business looking to engage a workforce across different countries—each with their own currencies, banks, laws, and infrastructure—can either try to deal with all the complexities, or pay everyone via crypto.

Source: Crypto use cases: 12 real-world stories of how millions of people are using crypto services today

Starbucks revolutionizes reward programs with Web3 technology

Starbucks Odyssey was a way for its most loyal customers to earn a broader, more diverse set of rewards beyond the perks they can earn today, like free drinks. Instead, Odyssey introduces a new platform where customers can engage with interactive activities called “Journeys” that, when complete, allow members to earn collectible Journey Stamps — which is Starbucks’ less geeky name for NFTs. At around 500 points, members will earn Stamps — that is, a coffee-themed NFT hosted on the Polygon blockchain. These Stamps also unlock special experiences. There will be three levels of benefits and experiences that can be unlocked. At the lower end, these could be online experiences, like a virtual class that teaches you how to make espresso martinis, or provides access to unique artist merchandise. As you earn more points and NFTs, you may then begin to gain access to real-world experiences, like special events hosted at Starbucks Reserve Roasteries or even a trip to the Starbucks Hacienda Alsacia coffee farm in Costa Rica.)

Source: Starbucks opens up its web3 loyalty program and NFT community to first beta testers

Our Contributors

John Egan

Head of Product (Crypto)

Mayank Singhal

Director, Payment Partnerships

Amy Fisher

Crypto & Web3 Lead

Mina Khattak

Head of Growth, Crypto & Web3

Pietro Moran

Director of Crypto

Ryan Grace

Head of Digital Assets

Arsen Torosian

Chief Strategy Officer

Aaron Stanley

Founder