Reputation now matters more than price

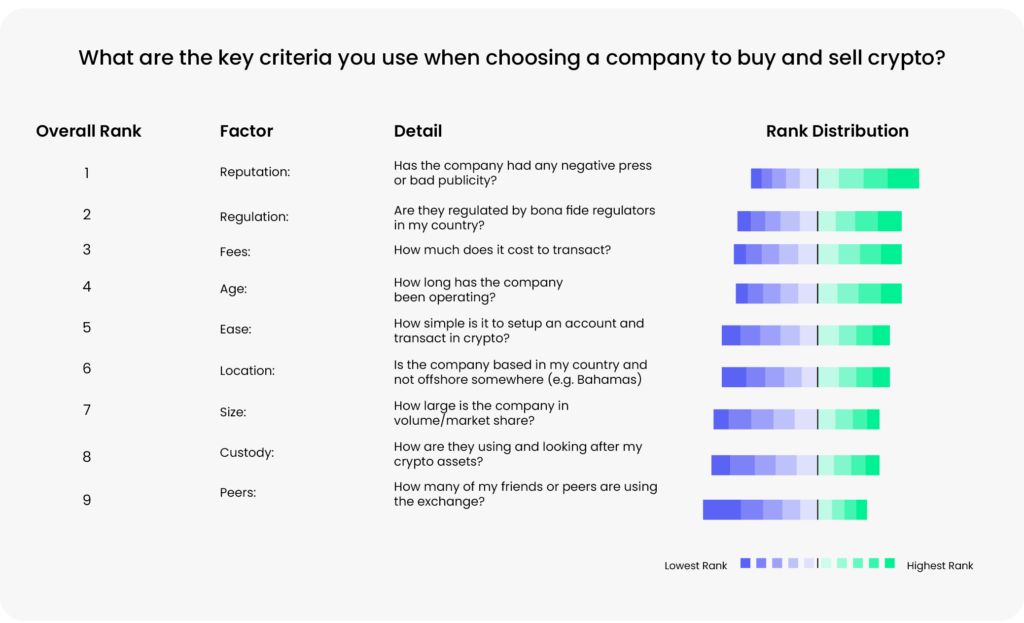

When performing due diligence, the two most important factors to consumers are a company’s reputation and regulatory standards, as opposed to price, which is typically a top decision-making factor. Factors ...

When performing due diligence, the two most important factors to consumers are a company’s reputation and regulatory standards, as opposed to price, which is typically a top decision-making factor.

Factors that are traditionally imperative for consumers — such as fees and simplicity of use — are now secondary to trust factors. Customers are willing to pay a premium for peace of mind, a trend we think of as a growing ‘trust premium’.

Interestingly, the time that a company has operated is highly important – nearly as important as fees. Consumers recognize that trust takes time to build, so incumbents have a trust advantage.

Overall, we interpret this trend as a flight to quality: while consumers now exert greater scrutiny over their service providers, most are long-term believers who seek to replace dubious providers with trustworthy ones.

Somewhat surprisingly, users report that a company’s custody protocols are relatively less important compared to other decision-making factors. This is surprising because many consumers previously lost their crypto because of improper asset custody, which enabled untoward practices like re-hypothecation.

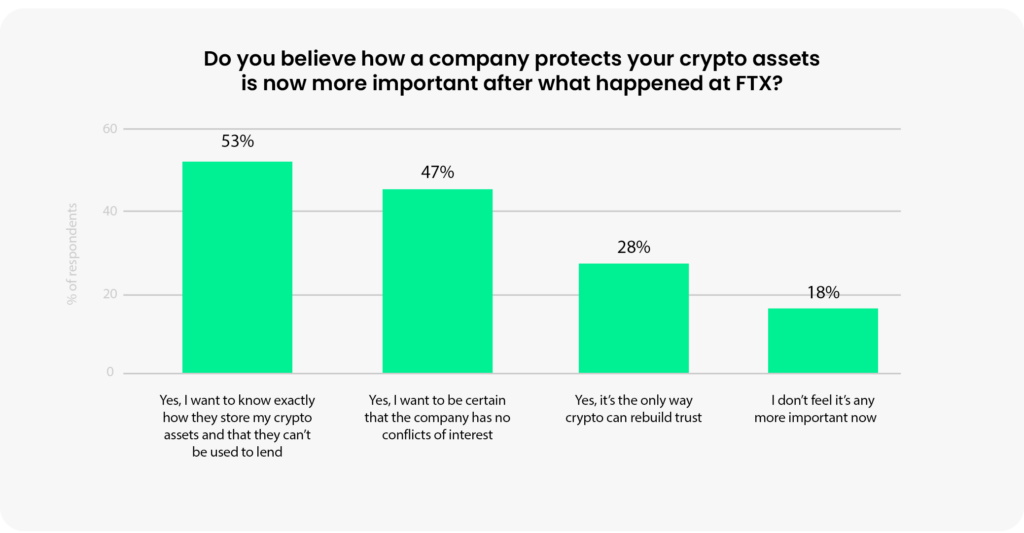

On one hand, it seems that consumers may be using reputation and regulation as a proxy indicator for custody. On the other, it’s possible that the term ‘custody’ is not commonly used or well understood by mainstream consumers. While users did not list custody as a key decision-making factor, elsewhere in the survey they expressed that the events of 2022 have made them more conscious of how their assets are stored: 53% stated that they want to know exactly how assets are stored and that their assets can’t be used to lend, and 47% want to be certain the company has no conflicts of interest.

stated that they want to know exactly how assets are stored and that their assets can’t be used to lend

want to be certain the company has no conflicts of interest

These data points indicate that custody is still a factor for customers, and the primacy of other factors in decision-making does not imply that custody should be any less important to providers. It’s now incumbent on crypto companies to make custody protocols robust, secure, and transparent.