Blazing a trail into crypto for bank holding companies

A conversation with Zero Hash’s Chief Legal Officer, Stephen Gardner

In recent years, the world of cryptocurrency has garnered significant attention from a variety of traditional financial institutions. Despite this backdrop, only a few banks and bank holding companies,* (BCH), have dipped their toes into the crypto waters. For example, although some of the largest brokerage platforms including tastytrade and Interactive Brokers (both powered by Zero Hash) and Fidelity have all offered crypto trading, other brokerages that are subsidiaries of bank holding companies have not. Specifically, neither Charles Schwab and Morgan Stanley E-trade, both of which are subsidiaries of bank holding companies, have yet launched a crypto product.

*A bank holding company is an entity that owns a controlling interest in one or more banks. While a bank holding company does not offer banking services directly, it manages banks that do.

To unpack this topic, we sat down Stephen Gardner, Chief Legal Officer at Zero Hash, to understand the full extent of bank holding companies’ involvement in crypto, the key considerations that they face, and the barriers they encounter.

To what extent are bank holding companies involved in crypto?

Bank holding companies have only just begun to explore the world of cryptocurrencies. Only a handful of bank subsidiaries of BHC’s, with BNY Mellon being the most recent addition, have obtained permissions from federal regulators like the Federal Reserve Board of Governors or the Office of the Comptroller of the Currency to engage in limited activities such as crypto custody for institutional clients in assets such as Bitcoin, and Ether.

What needs to happen for bank holding companies to get involved in crypto?

To expand their activities in the crypto space, bank holding companies need to work closely with regulators. I often emphasize the importance of clarity regarding customer disclosures and ensuring the delivery of a quality product. I believe the best starting point is by partnering with established licensed institutions like Zero Hash, which provide custodial and execution services.

What are the key considerations for bank holding companies?

When it comes to bank holding companies, several key considerations must be addressed. For the holding companies and their subsidiaries, the biggest hurdle will be the potentially onerous capital requirements for crypto under Basel IV. Furthermore, those BHC subsidiary companies registered with the SEC, particularly those with over 2,000 shareholders, need to consider Staff Accounting Bulletin 121. This bulletin requires banks to hold one-to-one crypto assets on their balance sheets, potentially impacting their capital positions. My thoughts on how BCH’s may be able to provide regulators with more comfort, reduce the perceived risk associated with mixing volatile assets and traditional banking practices is to separate crypto activities from banking operations for bank subsidiaries.

Notably, there are a number of ways to structure relationships with institutions like Zero Hash such that BCH’s can ultimately customize and control their overall exposure to crypto activities. And, we believe that we have a few models that can sufficiently abstract away certain risks associated with crypto activity support that we hope can ultimately provide banking regulators comfort and that also reduces or potentially eliminates BCH’s balance sheet exposure to crypto assets.

What are the barriers for bank holding companies?

There are two significant barriers bank holdings companies face when trying to engage in crypto. First, federal regulators have issued guidance stating that crypto activities are not generally aligned with safe and sound banking practices. Consequently, retail engagement with crypto is unlikely to be approved in the near future, making any interaction a compliance risk that many are averse from investigating further. Second, there is a reputational risk associated with the volatility of the crypto market. Many banks, including subsidiaries of bank holding companies,have limited their involvement or completely abandoned their crypto plans following 2022’s turbulence. To build confidence, the industry as a whole needs to demonstrate responsible practices to regain stability.

The Federal Reserve has expanded its oversight of crypto activities for all US-regulated banks. Recent guidance specifically references stablecoin issuances, crypto-collateralised lending, crypto trading, and custody.

The Federal Reserve is partnering with industry and academic experts to better understand and address the risk of crypto activities within banking institutions, which is optimistically a positive step forward. Following this guidance, regulated banks have been required to obtain written approval from the Fed before implementing distributed ledger technologies or offering crypto services to customers.

What are the lessons to be learned from bank holding companies that have tried to get involved in crypto?

My experience tells me, any process is likely to be lengthy and challenging, so committing to a thoughtful crypto strategy alongside experienced, reputable partners is crucial. Regulators still view crypto-focused strategies as inherently risky, especially for the banking world, and applications for charters from other institutions have been either rejected or stalled. However, progress is certainly possible, and the results are worthwhile. Some bank subsidiaries of BHCs, like BNY Mellon, have successfully integrated custody services for institutional clients. When one reliable player makes headway, it greases the gears for all that follow.

Why should bank holding companies partner versus going solo?

Partnering with institutions like Zero Hash offers numerous advantages for entities that are part of a bank holding company group of companies. By working with these entities, banks or broker-dealers and other financial services subsidiaries of BHCs can provide their customers with secure and regulated access to crypto services, without the need to build the technology or regulatory structure. Collaborating with trusted and licensed partners adds an extra layer of security, ensuring a more comprehensive and reliable customer experience.

What needs to change with regulation to make it easier for bank holding companies to enter crypto?

We’re seeing three trends that are impacting the regulatory outlook which can all hopefully be accelerated.

Firstly, the SEC’s enforcement actions are slowly providing clarity on the regulatory framework, helping bank holding companies and their subsidiaries understand the boundaries, in the eyes of our federal securities regulators, and requirements for engaging in crypto activities. In most cases, the SEC is considering crypto assets as securities; however, since the crypto ecosystem covers thousands of assets, we’ll want to see what the outcome of these enforcement efforts will look like, and to what extent all assets receive similar treatment, not just under the view of the SEC, but also by the courts. This will affect which entities under the bank holding company’s umbrella can engage in which types of crypto related activities.

Secondly, collaboration between federal regulators, such as the Federal Reserve and the Office of the Comptroller of the Currency, is crucial to establish consistent guidelines and facilitate a more streamlined process for bank holding companies to enter the crypto space.

Lastly, ongoing industry dialogue and engagement with regulators can foster mutual understanding and lead to the development of balanced regulations that protect consumers while allowing for innovation in the crypto industry.

Why should bank holding companies consider entering crypto?

There’s no denying the growing demand for crypto from retail customers; crypto is here to stay. This gives the entities under the U.S.’s well known bank holding companies the opportunity to both retain customers while growing deposits in a rising interest rate environment, by providing regulated and supervised access to cryptocurrencies. In fact, we recently commissioned a study with 3,000 global consumers, across the U.S, UK, Brazil and Australia and one of the key trends we identified is consumers want to use brands they are already familiar with and trust to engage in crypto. 80% of consumers want to use a traditional financial services company — and 71% of consumers are using financial services companies right now to engage with crypto. The shift is accelerating the convergence between crypto and traditional finance and presents a unique opportunity for trusted brands, like bank holding companies and their subsidiaries to win market share and unlock new revenue streams.

Zero Hash will be releasing the full report from the study ‘Unlocking the next wave of adoption in crypto through trust’, soon. Register your interest to get access to a copy of the report. ([email protected])

What advice and next steps should bank holding companies take before entering crypto?

Before taking the leap into the crypto world, bank holding companies should establish a comprehensive, cross-entity strategy that aligns with their risk appetite, regulatory framework, and customer demand. The crypto ecosystem is vast: to some, crypto simply means buying Bitcoin, while to others, the landscape of technologies and rewards poses a new way to manage and access money. Bank holding companies need to understand which specific types of services fit them and their subsidiaries best.

Once they’ve made those strategic decisions, partnering with established institutions specializing in crypto services can provide valuable expertise and support to expedite implementation. Additionally, active engagement with regulators is crucial to understanding the evolving regulatory landscape and staying compliant. Crypto’s evolution is a long-term trend, and we always advise that any institution choose an appropriate path without skipping any steps.

Watch the full discussion with Stephen Gardner, Chief Legal Officer of Zero Hash

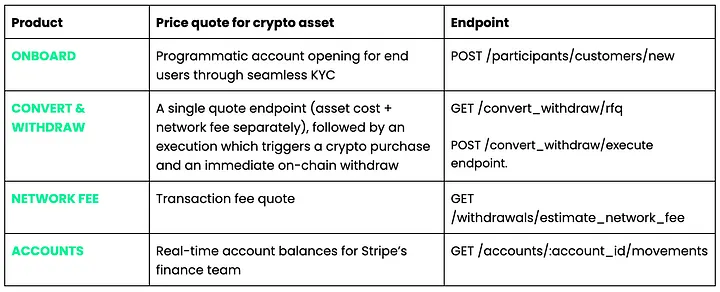

Learn how Zero Hash is supporting global innovators including Stripe, Shift4 and Interactive Brokers to move in to the crypto space.